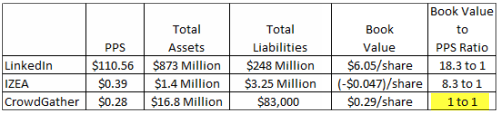

There is a lot of activity surrounding social media stocks with the Initial Public Offering of Facebook (NASDAQ: FB) coming on Friday. The new listing, which could see the company valued at as much as $100 billion, has investors and analysts already concerned that the world’s largest social network could be overvalued from the get-go. Rather than try to ride that wave, savvy investors are looking to other social media and networking-related stocks that may offer a larger upside potential. An assessment of book value to price and shareholder equity/deficit of companies such as LinkedIn Corporation (NASDAQ: LNKD); IZEA, Inc. (OTCQB: IZEA); and CrowdGather Inc. (OTCBB: CRWG) reveals some stark differences and showcases where true value propositions may be found.

While other Internet microcaps are burning through money like it is free, CrowdGather has a very high gross margin business that should make it easier for them to deliver bottom line results when revenues exceed expenses. In the most recent quarter, the company realized revenues of $549,750 for the three months ended January 31, 2012, as compared to revenues of $380,212 for the three months ended January 31, 2011. The absolutely stunning part: cost of revenue for the three months ended January 31, 2012 was $4,793, as compared to cost of revenue of $44,186 for the three months ended January 31, 2011. CrowdGather delivered a gross profit margin of almost 99% in their last quarterly results filing. If the company is able to maintain margins anywhere close to this as they scale, shareholders could see significant net income and EPS from the company in the future.

Insiders are not missing the big picture with CrowdGather as evident in the buying activity last year at higher prices than current levels. While other Internet micro caps are diluting to raise funds, CrowdGather is sitting on cash. Further, beta testing for its ad server is nearly complete with a launch planned for this fall, which could increase revenue momentum over the long term as the company will be able to more effectively target all of their hosted forums for advertisers seeking a specific vertical or demographic.

At the end of the latest quarter, CrowdGather had roughly $2.7 million in cash and $16.8 million in net shareholder equity. There are very, very few companies that post positive shareholder equity in the Over The Counter markets. Total liabilities only equal $83,000; giving CrowdGather a book value of 29 cents per share. Shares closed on Tuesday, May 15, 2012 at 28 cents each which equals a market cap of $16.3 million.

Breaking it down:

Taking the facts and ignoring the hype often results in a clearer picture of value. Pitting CrowdGather toe-to-toe with any of its micro cap Internet or Social Media peers shows a small, but sound business strategy with solid margins and wise financial sense. It also shows that the company is only trading at the value of its cash and assets without any real regard for its growth prospects. The numbers don’t lie.

CrowdGather (CRWG) Stock Quote and News:

LinkedIn (LNKD) Stock Quote and News:

IZEA (IZEA) Stock Quote and News:

Facebook (FB) Stock Quote and News:

(not active until Friday)

Disclaimer: Neither http://www.otcshowcase.com nor its officers, directors, partners, employees or anyone involved in the publication of the website or newsletters (“us” or “we”) is a registered investment adviser or licensed broker-dealer in any jurisdiction whatsoever. Further, we are not qualified to provide any investment advice and we make no recommendation to purchase or sell any securities. The prior article is published as information only for our readers. otcshowcase.com is a third party publisher of news and research. Our site does not make recommendations, but offers information portals to research news, articles, stock lists and recent research. Nothing on our site should be construed as an offer or solicitation to buy or sell products or securities. This site is sometimes compensated by featured companies, news submissions and online advertising. Viper Enterprises, LLC (parent company of OTC Showcase) has been compensated two thousand dollars by an unaffiliated third party, Accelerize New Media, for its efforts in presenting the CRWG profile on its website and distributing it to its database of subscribers as well as other services. Please read and fully understand our entire disclaimer at http://www.otcshowcase.com/about-2/disclaimer.

According to the International Diabetes Federation, more than 500 million people will be diagnosed with diabetes in the next two decades, a more than 50 percent increase from today. Technologies are available presently to help manage the frequency, complications and costs associated with diabetes. Read the

According to the International Diabetes Federation, more than 500 million people will be diagnosed with diabetes in the next two decades, a more than 50 percent increase from today. Technologies are available presently to help manage the frequency, complications and costs associated with diabetes. Read the

0 comments

Add your comment

Commenting is allowed only for registered users.